Buildings are responsible for 40% of global greenhouse gases. As leaders, we can drive change.

By Stéphane Villemain, Vice President, Corporate Social Responsibility, Ivanhoé Cambridge

Ivanhoé Cambridge’s investments are shaping the urban fabric in dynamic cities around the world. Ivanhoé Cambridge invests responsibly with a view to generate long-term performance. It is committed to creating living spaces that foster the well-being of people and communities while reducing its environmental footprint.

Ivanhoé Cambridge invests internationally alongside strategic partners and major real estate funds that are leaders in their markets. Through subsidiaries and partnerships, the Company holds interests in more than 1,100 buildings, primarily in the industrial and logistics, office, residential, and retail sectors. Ivanhoé Cambridge held C$60,4 billion in real estate assets as of December 31, 2020, and is a real estate subsidiary of the Caisse de dépôt et placement du Québec (cdpq.com), one of Canada’s leading institutional fund managers. For more information: ivanhoecambridge.com.

Eighth Avenue Place, Calgary, Alberta

Setting ambitious targets

The World Economic Forum states that buildings now account for close to 40% of global greenhouse gas emissions and that in order to help fight climate change, organizations across the globe are looking at ways to reduce their impact on the environment and at implementing carbon reduction roadmaps. We believe that driving sustainable change requires bold leadership and a steadfast commitment to have a positive impact on the environment.

Moreover, in her 2019 U.N. Climate Action Summit remarks, Greta Thunberg called upon business leaders to challenge the status quo. To make better investment decisions, long-term investors should systematically consider ESG criteria throughout the investment process (strategy, acquisition, development, asset management, and disposition). As one of the world’s largest generators of carbon emissions, it is vital that property investors and managers define zero-carbon strategies to ensure the resilience and sustainability of their portfolios with four main drivers:

- Natural disasters such as floods, storms, and wildfires, which are increasingly linked to climate change, will significantly affect real estate.

- Governments will enact more and more regulations affecting real estate, including energy efficiency standards and carbon taxes.

- Demand from tenants and users for low-carbon real estate is growing.

- Enhancing the resilience of assets will be more profitable in the long term.

There are different scenarios for how much the planet’s average temperature will rise by 2100, with significant amplitudes that depend on the decisions that we make today. If we stick to the current pathway without doing anything, the increase could exceed 5°C, which would have serious consequences for ecosystems and even worse ones for humanity. For this reason, Ivanhoé Cambridge has made the choice to align with the most ambitious carbon-reduction policies to make the greatest possible contribution to mitigating climate change.

Long-term profitability through sustainable investments

At Ivanhoé Cambridge, we look to improve the efficiency and resilience of our assets toward a net-zero carbon portfolio. We invest with conviction to achieve sustainability through investments in high-quality real estate properties, projects, and companies. This principle underpins all our decisions and actions. By wisely investing the funds entrusted to our care, we not only contribute to transforming the urban landscape to meet the ever-evolving needs of our communities, but we also enable the transition to a more inclusive, equitable, and environmentally sustainable future. Over the long term, we believe that a sustainable real estate investment is a profitable investment.

Our industry has a key role to play in mitigating climate change. We see this as a significant investment opportunity. We believe that capital is needed to fund the transition towards sustainability and that our efforts will contribute to future-proof our assets. As an example, we are the first investor in Fifth Wall’s Climate Tech Fund, which aims at funding R&D that is required to decarbonize the real estate industry.

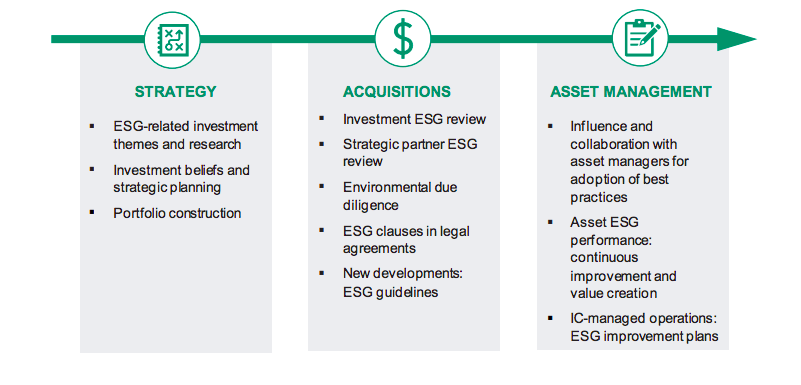

We consider ESG criteria through the full investment life cycle—from investment strategies to new transactions, asset management, and disposition—allowing for a tailored approach that reflect the particularities of each of our investment, its sector, the geographical situation, the type of structure and the partners involved.

ESG Criteria Through Full Investment Life Cycle

Contributing to the Economic and Social Vitality of Our Communities

Real estate affects people’s daily lives: studies have found that in North America and Europe, we spend up to 90% of our time in buildings. It goes without saying that real estate investors have a unique opportunity to play a large role in improving people’s quality of life.

More than ever, our spheres of life must be entirely rethought to include the mobility, flexibility and connectivity to which users aspire. We need to rethink the cities of the future and design mixed urban environments where residential, retail, office, and logistics spaces are combined and integrated in response to the needs of each community. We need to be even more effective in leveraging technology for everyday efficiency, and, of course, we must make health, safety, and well-being central to all our initiatives from their very conception.

When the social aspect is by nature at the heart of priorities, we can favourably impact the quality of life in and around our properties and drive healthy, resilient living environments that will have a positive and lasting impact on communities. This means contributing to society through programmes such as certifications or measures related to health and wellness, affordable housing impact strategies, community investment programs that are reflective of the strategic objectives and values as well as keeping diversity, equity, and inclusion top of mind for employees, partners and investments. It can also be achieved through the integration of social factors in investment analysis such as assessing aspects related to health and safety, wellness, accessibility of services and transportation, and tenant and community engagement programs.

COVID-19 Recovery: Adapting, Innovating and Making a Commitment

We believe that the period of transformation brought about by the COVID-19 pandemic is an opportunity to demonstrate our industry’s flair for innovation and ability to reinvent the industry through solutions that reflect societal change and that benefit our communities. With the sweeping social, environmental, and technological trends we foresee, the pandemic is speeding up the transformation of the spaces where we live, work, and play. Beyond the immediate consequences, it is essential to study the structural and fundamental shifts that are occurring. New trends are emerging and others, already identified, are accelerating. While it is still too early to assess the full impact of the pandemic on the industry, we see it as an opportunity to strengthen our commitment to invest responsibly and to promote business models with sustainable impacts.

At Ivanhoé Cambridge, we are committed to having a positive impact on the environment; and the climate emergency is driving us to do this faster, and to go further. The steps we are taking are also enhancing the resiliency of our assets. We are committed to working toward this goal with diligence and humility, in close collaboration with our tenants, employees, and partners around the world.

A Pilot Project That Pioneered Our Net-Zero Carbon Ambitions

Édifice Jacques-Parizeau, Montréal, Québec

Édifice Jacques-Parizeau houses the Caisse de dépôt et placement du Québec and Ivanhoé Cambridge. The building offers state-of-the-art energy efficiency and comfort; its materials were chosen to maximize the amount of natural light reaching the interior.

- The double-wall-ventilated curtain wall design optimizes energy use and penetration of natural light to the building interior.

- Cool air is preheated by the thermal energy of exhaust air, and ventilation is via raised plenum flooring.

- Although Édifice Jacques-Parizeau uses mainly natural gas for heat, hot water, and humidity control, innovative energy efficiency approaches help minimize its use.

- The building’s residual carbon emissions are offset by purchasing green energy from the Gros Morne wind farm in Gaspé, Quebec.

- The building has achieved both LEED Operations and Maintenance Gold and BOMA BEST Gold certifications, as well as Energy Star certification with a rating of 90. In addition, it was awarded the CaGBC Zero Carbon Building Performance Standard certification. With its energy-efficient design, the building was an excellent candidate for Zero Carbon Building (ZCB)

- In 2021, it was also awarded Zero Carbon Building – Performance certification.

Learn more about our commitment to achieving net-zero carbon by 2040.

Stay connected LinkedIn | Twitter | Facebook | Instagram

This opinion piece has been shared as part of the Clean Recovery Breakthrough Series.