Scott spent a decade working in Silicon Valley as a tech entrepreneur and venture capitalist. A believer in the power of innovation to solve big problems, Scott decided to apply his expertise to energy and resource systems in 2004. After co-founding McKinsey’s Clean Energy Practice advising hundreds of leading companies, many governments, and a number of the largest institutional investors in the world, in 2014 Scott helped start Generate Capital, a San Francisco-based infrastructure investment and operating platform.

What sets Generate Capital apart from other financing companies?

We’re a balance sheet business, not a fund management platform, which is a novel alignment model with investors. It also provides substantial flexibility in the way the company can support its investments and its partners. We recently raised USD$200m worth of institutional equity led by our new partner, Alaska Permanent Fund Corporation, to add to prior equity and debt capital raised since the company’s founding.

Generate Capital has found its niche as the capital partner for the ‘Resource Revolution,’ a phrase we coined at McKinsey. The Resource Revolution is all about doing more with less, particularly with respect to natural resources. This kind of productivity equation has propelled economic growth for centuries. We’ve seen it in the Agriculture Revolution, the Industrial Revolution, more recently in the Digital Revolution – all of which were more focused on labor productivity – and now we’re seeing it in a fourth revolution…the Resource Revolution.

For us, that translates into investing in small-scale energy, water, waste and agriculture infrastructure projects that, despite being the most economically efficient, tend to be ignored by most traditional sources of capital due to their size, maturity, and complexity.

What are the signs that the Resource Revolution is happening?

In the energy space, we’re seeing signs that it’s happening in something as simple as the increased fuel economy of internal combustion engines. But there are more dramatic improvements. A great example is building efficiency improvements that we’re seeing across the U.S., and particularly in places like Japan where energy has been a scarce resource for a lot longer.

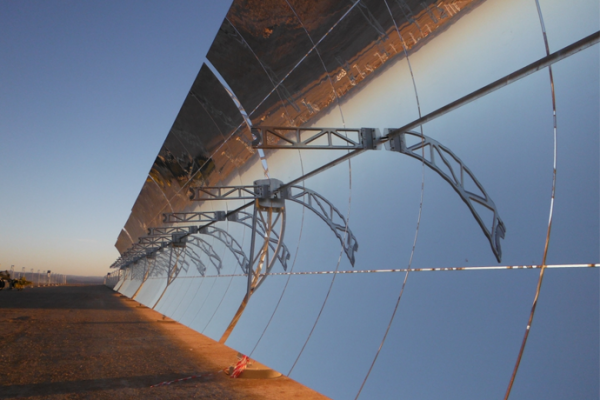

We’re also seeing the Resource Revolution in the growth of the renewable energy sector. More than 50% of growth in energy production capacity added to the grid in the last several years has been renewable energy. And in food and agricultural systems, we’ve seen great productivity growth associated with new fertilizers and agricultural inputs, new ways of irrigating crops, and new crop rotations…all of which are designed to increase the yield from the land.

What are the biggest opportunities in the clean energy economy for investors?

There’s going to be a tremendous amount of capital deployed in renewable energy, especially in distributed energy opportunities around solar and energy storage.

Transportation, specifically electric mobility, is also attracting a lot of attention, and it’s not just Tesla offering electric vehicles to consumers anymore. Municipal bus fleets are converting to electric transportation, and many major global economies are outlawing petroleum-based vehicles.

This is happening very quickly in places like the UK, France and China. China, as the biggest driver of demand for the automotive sector, is really signalling to the rest of us how the future infrastructure of the world will be built.

When looking at tomorrow’s clean energy investment opportunities, check out what China is doing. Their market signals not only attract attention, but significant capital.

What are the biggest barriers to a full transition to the clean energy economy?

If you think the clean energy economy is going to happen tomorrow, you’re going to be disappointed. There are really two major barriers:

- How long it takes to refresh the infrastructure

- Incumbent inertia within the existing system

The world’s energy and resource infrastructure has taken the past 100 years to build, and that is very hard to change. In places like the U.S. and Europe, low population growth and low economic growth translate to slower building of new infrastructure, though there is an aging infrastructure that needs replacing but will take some time.

But in China and other emerging countries, where both economic growth and population growth are much higher, and pollution becoming a much bigger, more noticeable problem, there is a more urgent need to build more efficient infrastructure.

There is also a lot of inertia within existing systems and, as always, existing players who are threatened by the transition to a clean energy economy are putting a lot of money into policy advocacy and other barriers that protect their position as the incumbent.

How can players in the clean energy economy harness the huge amounts of capital available?

There is a lot of discussion about the “clean trillion” in the sustainability world…the notion that we need a trillion dollars a year to go into the clean economy to solve our sustainability challenges. I take a slightly different angle on this question. I believe the trillion dollars and then some is already out there, ready to be deployed into good projects with good returns. The challenge is that the people asking for the money lack the strategy, structure and team that would build trust with the asset holders and thus cannot mobilize the capital.

GLOBE Capital returns to Toronto on February 27-28, 2019.

Join leaders in finance, infrastructure and cleantech to discuss how to capitalize on opportunities in the clean economy.

Learn more