By Markus Lampinen

CEO, CrowdValley

Making Economic and Regulatory Sense of Investment Channels

On an institutional level, there are a number of barriers that impede both clean-tech innovation and the implementation of available green technologies. Primarily, these barriers appear to be economic in nature and are most obvious with attempts to adopt new technology or engage in disruptive practices.

However, looking deeper into these barriers reveals that in the long term, they no longer hold argument. Over time, the energy and cost savings more than compensate for the upfront costs associated with the implementation of green innovation. Alternatively, businesses, government, and municipalities need to consider the implications of not going green. Dismissing or delaying the transition to clean infrastructure has the potential to cost far more than embracing it does, considering the emergence of stricter environmental regulations, stakeholder demands, competitiveness, brand image and corporate social responsibility.

A recent HBR blog highlights a new study that reveals sustainability is an increasingly important factor in attracting and managing talent. Current employees also indicate that they want to be involved in developing a sustainability strategy. When you consider that 50% of younger employees and 20% of older employees expect to play a role in how their employer approaches sustainability and building for the future, this factor is extremely important.

The Future of Green Technology Investment

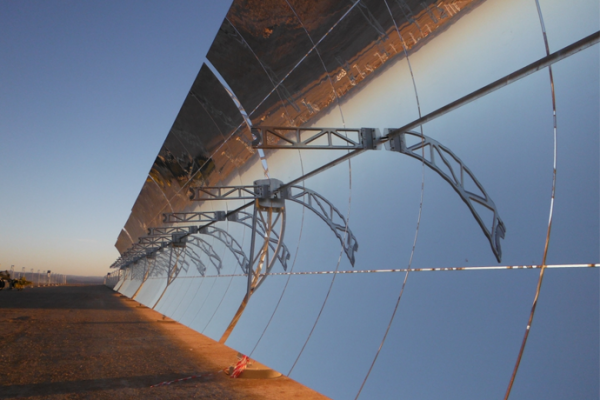

2016 saw significant gains in green and sustainable energy investment. While there was a reported 18% decline in the level of new investment (falling to $287.5bn in 2016, from $348.5bn in 2015), such investment was indicative of gains in infrastructure and economy of scale following lower equipment and implementation costs. Additionally, we saw a 40% increase in capital spending commitments for offshore wind power, hitting $29.9bn in 2016, highlighting a strong institutional belief in the efficiency and returns that this industry presents.

Factors contributing to the slight decline in green infrastructure investments include the Chinese economic slowdown and the fact that both China and Japan have cut back on large scale renewable development projects in a bid to focus on the capacity they have developed to date. Reduced equipment costs can also be attributed to competitiveness in solar and wind power. This is an early indicator of the future benefits society will accrue as efficiency becomes an increased focus in this sector.

In the past, most corporations and institutions tended to ignore the public benefits of clean technology and green innovation. Employment, fuel diversity, price stability, and other indirect economic benefits of renewables also accrue to society as a whole. With fossil fuel infrastructure previously being the best cost-effective option, along with it yielding greater returns, a company would experience more inertia from it’s investments in sustainable practices. At this time, we are privileged to enter an era in which green technology is attractive both from a societal and economic perspective.

Creating an Enabling Environment for Green Investments

Public finance is a key policy instrument to both incentivize and enable the transition to green growth. Some estimates suggest public finance has the potential to mobilize 5X the contribution of the private sector. However, this mobilization is thought only likely if combined with aligned policy and regulatory measures.

We cannot over estimate the need for a strong and binding policy and regulatory framework. Having this in place will create demand for investment in green products and services. Additionally, new standards should be given sufficient lead-time to alert and encourage investors in clean-tech growth.

Price signals can create both incentives and disincentives for investors. Green taxes and prices should be kept progressive to promote equality among income groups and, if necessary, provide grants to low income sectors especially if other subsidies are removed.

In the early stages of sustainable market development, governments should have active financial programs to develop investable projects. Public finance can be used to lay foundations through demonstration, public procurement, and support for project preparation.

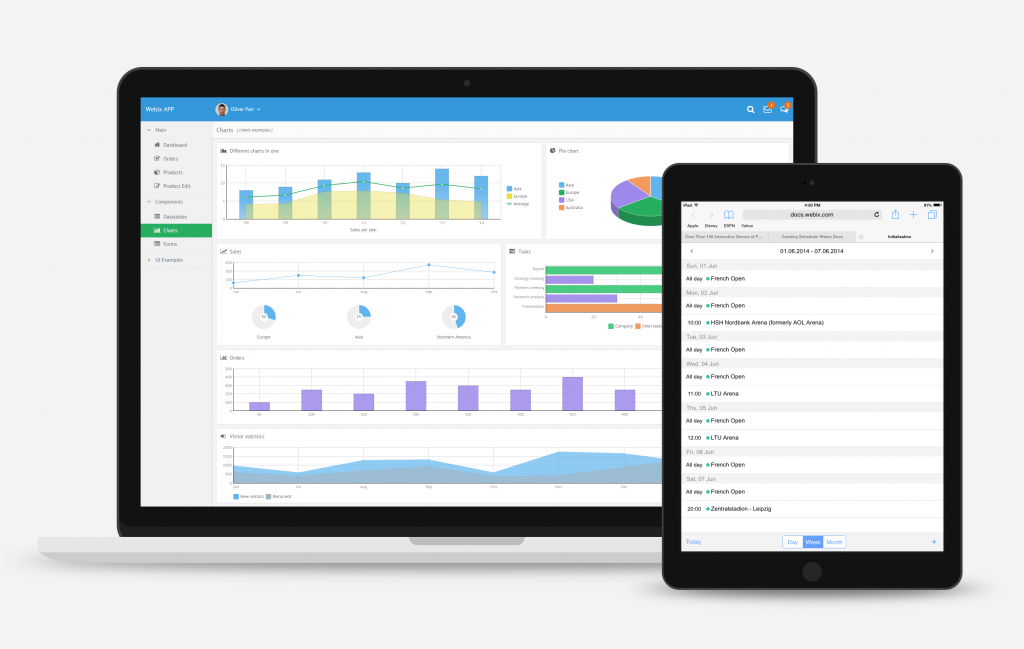

Regulations need to be complemented by infrastructure that creates channels of investment for both institutional, accredited and non-accredited investors. Recent years have seen the rise of a number of financial technology firms providing these channels, among which Crowd Valley stands at the forefront. Crowd Valley provides a comprehensive back office cloud and API-based infrastructure needed for the creation of streamlined investment and capital marketplaces. As well, Crowd Valley seamlessly integrates 3rd party payments, ID verification, credit review and equity management, to name a few.

Channels such as Crowd Valley increase accessibility for a majority of the population to partake in alternative finance and provide the necessary ability for individuals to have a direct stake in the future of the planet. Through its internal infrastructure, such channels demonstrate the fintech industry’s commitment to a more sustainable and efficient future.

Will There Be Profit?

Today’s highly dynamic technology environment increases the profitability potential of clean-tech investments as nations lay the physical and regulatory infrastructure for a greener future. Hence, it is in the best interest of both corporations and civil society to funnel investment towards green technology and low-carbon infrastructure. Practically speaking, the boost in financial inclusion is increasing the volume of funds into this sector – incentivized by societal benefits and a high rate of return due to clear long-term efficiency gains.

Increased democratization of finance, the challenging of cultural norms, and the circumventing of institutional inertia opens the door for green technology and infrastructure to provide a huge financial and public interest pay off.

References

Green_it_barriers_versus_benefits

Barriers-to-renewable-energy

Creating-enabling-environment-green-investments

Sustainability-matters-in-the battle for talent

Crowd-valley-releases-worlds-first-public-digital-back-office-for-online-investing-and-lending-services

Crowd-valley-to-address-democratization-of-finance-at-global-solutions-summit

Clean-energy-investment/