By: Emile Lavergne, Senior Consultant, ESG Strategy & Sustainable Finance, The Delphi Group

The race to net zero is off to a flying start.

Public and private commitments to reach net-zero carbon emissions by 2050 have doubled in less than a year. By the time COP26 in Glasgow rolls around in November this year, countries responsible for 78% of global GDP will have pledged to reach net zero by 2050 or, in the case of China and Brazil, 2060.

Now comes the tough part. We have a lot of work to do and we need to find a way to pay for it.

How can we mobilize capital to support net-zero ambitions?

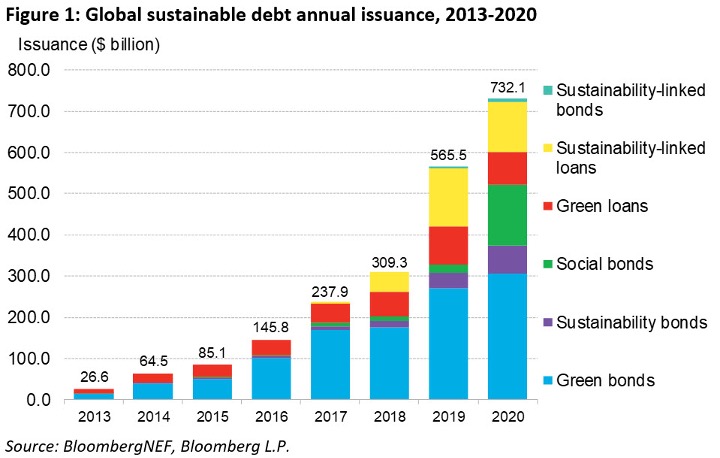

Sustainable finance is an umbrella term for funding that supports projects and organizations delivering green, social, and climate-related impacts. While net-zero targets have grown, sustainable finance has also skyrocketed, as seen by the increase in sustainable debt issued in 2020:

In the chart above, you’ll notice four categories of sustainable finance:

Green and social finance (including bonds and loans) fund projects, assets, and activities tied to beneficial environmental or social impacts. These depend on frameworks identifying on which projects the use of proceeds (capital raised) can be spent.

Sustainability bonds is a catch-all term for bonds raising capital for sustainable projects, as defined by the use of proceeds. These could include projects that touch on both social and green topics and are therefore classified as sustainable, as opposed to specifically labeled green or social.

Sustainability-linked finance (including bonds and loans) provides an incentive for a company seeking a loan or issuing a bond to reach a pre-determined sustainability goal. For example, if a company reaches a certain key performance indicator, they may get a lower cost of capital, as agreed with the lender at closing.

The gap between the sustainable finance market and net-zero targets

The sustainable finance market was designed to finance projects defined as green, social or climate–related and it is effective in this regard. However, these types of financing are not designed to support all projects that could help companies reach carbon neutrality, especially in high–emitting sectors (e.g. oil & gas, mining, etc.). These high-emitting sectors have the most potential to move the dial to reduce global GHG emissions.

Sustainability-linked financing is relevant for corporate commitments to net zero, but is not used finance to specific projects.

Enter transition finance—a growing market where investors finance projects not considered green, social or climate-related that nevertheless advance the transition to net zero. For example, efforts to reduce the emissions intensity of energy production in the short term, including oil and gas, may be considered a transition activity but would not be considered a climate-related activity due to the narrow definition of ‘climate-related’ only including non-emitting sources of energy (i.e. excluding oil and gas). Hence the name ‘transition’ finance—it finances projects that contribute to a change in the highest-emitting sectors to enable the world to reach the goals of the Paris Agreement.

Conventional financing remains available for all projects. However, a growing number of investors are interested in growing the climate resilience of their portfolios and supporting sustainability efforts, meaning the transition finance market could enable companies in high–emitting sectors to access capital.

The challenge is that participants in the global capital markets have not agreed on a definition of ‘transition’. Without the clarity, transparency, and assurance of a definition, investors may be reluctant to invest in projects essential to reaching net zero due to concerns about the climate resilience of certain sectors, like oil and gas. The transition will be implemented differently across sectors, and ensuring investors, issuers and regulators understand what is considered eligible under a definition of ‘transition’ will reduce friction for companies in high-emitting sectors to access financing.

Defining transition finance will unlock new options for corporations

Green and social finance both have broadly accepted definitions. They are defined through industry group principles and taxonomies (the International Capital Markets Association (ICMA) definitions, for example). The European Union has stated how it defines ‘sustainable finance’, and separately, how it defines a ‘sustainable’ activity with the EU Taxonomy.

The ICMA and the Climate Bonds Initiative have both published documents to begin to build a normative definition of ’transition.’ The OECD has also published Transition Finance Guidance.

To work through how ‘transition’ might be defined in a Canadian context, the Canadian Standards Association (CSA) has assembled a Technical Committee to work to develop a private sector-led definition of ‘transition’, along with sector-specific taxonomies for natural resource sectors across Canada. The CSA work ties into the international efforts to define ‘sustainable finance’.

Other countries, including Australia and Japan, are working to define what a transition would look like for their economies. We can expect Canadian and Australian definitions to diverge from Western European definitions, given that these countries’ economies have a strong reliance on natural resource sectors.

Next Steps

Despite the lack of definition, a few trailblazers have taken the lead with early transition finance transactions, notably HSBC and BNP Paribas. These transactions are built on foundational frameworks established by the ICMA and other industry voices.

It is clear that transition finance can accelerate the race to net zero by filling a gap in the existing sustainable finance market. Establishing a definition in the Canadian context will activate its potential. In the meantime, I invite Canadian companies to consider how transition finance could apply to their sector and their strategies.

To explore this timely and important conversation, join us for the GLOBE Advance Transition Finance Session.

Further Reading

Net zero

- Nationally Determined Contributions Tracker (Country commitments made in support of achieving the goals of the Paris Agreement), World Resources Institute

Thought leadership on the topic:

- Canada’s Transition Angle to the Great Taxonomy Debate, Scotiabank, 2020

- Transition Bonds – New Funding for a Greener World, BNP Paribas, 2019

- Why Transition Finance is Essential, HSBC, 2020

Norm-setting documents:

- Climate Transition Finance Handbook, ICMA 2020

- Financing Credible Transitions, Climate Bonds & Credit Suisse, 2020