By investing in the Climate Investment Funds (CIF), advanced economies have helped the developing world more fully participate in the global energy transition. More than 300 projects later, Mafalda Duarte, who heads up the funds, is now looking to keep the magic going.

A decade ago, 14 nations—led by the United Kingdom, the United States, Japan, and Canada — came together and opened their cheque books to create the Climate Investment Funds. The now-USD$8.3 billion fund is helping 72 emerging and developing economies worldwide prepare for and — bounce back from — the impacts of climate change. Under Mafalda Duarte’s leadership, CIF has since distributed the funds as direct grants, looking into new mechanisms that will mobilize climate finance from capital markets.

You oversee funds that have helped millions of people prepare for today’s challenges those that lie ahead. What’s that like?

I’ve been working with CIF for eight years now, and have been leading the funds for the last four. It’s been an honor to work with a number of climate champions out there in the developing world, as well as with large financial institutions who have been willing to make different investment choices than they would have in the past. The work we do to support and empower champions working in renewable energy, energy efficiency, sustainable transport, water management, and agriculture is humbling, and a privilege.

How exactly do you help those champions?

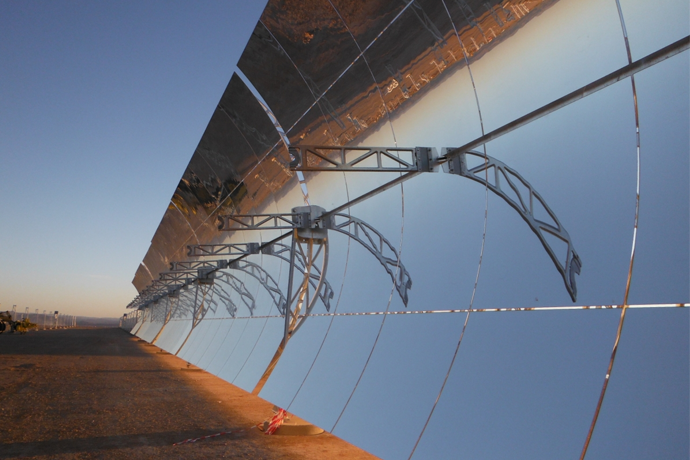

We support the markets and business models that will help clear the way for these countries to achieve a low-carbon future. Part of this process is providing concessional finance in the millions, sometimes hundreds of millions, of dollars. Another part is looking at institutional and regulatory frameworks they operate within, and figuring out what changes are needed — and what assistance and technical capacity might benefit them. We help bring all the key stakeholders together. From a technical and political economy standpoint, regulatory reform changes are far from straightforward. We also make a significant difference in that we de-risk and lower the cost of capital. We do this for well-known technologies, such as wind, that are proven but have not seen enough investment in a given country; and for renewable energy technologies that have less of a track record, such as concentrated solar power.

Where have you made the biggest mark?

We’ve tried to help first movers, with Mexico being one successful example. In 2008, when we started, there was very little renewable energy investment, and that was of course the year of the global financial crash. We were in there, helping with the first deals that led to growth in the wind sector. In other countries, like Kazakhstan, we have helped change their renewable energy laws. We had a stake in their first solar and wind projects to demonstrate their investment viability, and we also learned a lot about how to enhance their regulatory framework to better support renewable energy sources.

CIF has completed more than 300 projects. Which one or two stand out for you?

One of the projects we’re most proud of is our intervention in Morocco, which resulted in the 500 MW Noor Concentrated Solar Power complex—that country’s first utility-scale solar energy facility. To make that happen, we pioneered a different financial structure. By being there with other development finance institutions, we gave confidence to a number of investors. Our contribution helped reduce the project costs by 25 percent. Concentrated solar power is still a costly, early-stage technology, but it has a lot of potential. Our intervention significantly reduced the level of public subsidy that was needed to get it done.

What mistakes have you learned from?

Given how carefully we assess each prospective investment, the lessons we learn are more about how we adapt our practices to respond to a given nation’s specific needs. For example, we have a big program in Nigeria. We realized early on that we wanted to facilitate loans to help consumers develop small-scale renewables. To do that, we needed to rethink the way we approached the local commercial institutions in that country. This included considering the types of the conditions that would encourage those institutions to develop credit lines for these businesses. The lessons we are learning are more around our practices, and how we approach project design.

Your team has developed some serious expertise on renewables in the developing world. How do you share those findings?

From the beginning, we knew we would be a true learning laboratory. We wanted to gather insights and share them widely within developing countries, but also internationally. Both our geothermal and concentrated solar power experiences provide lessons that developed countries can learn from. The same is the case with credit lines that we have helped structure in Turkey and Tajikistan. We link the countries together with international experts around specific themes, such as microgrids and off-grid solutions, or the role of women in the energy transition. We’ve had Cambodia and Zambia exchange practices on water management, and Brazil and Mozambique in forest management—they have similar challenges and also of course both speak Portuguese! We bring them together, we ask them what they want to learn, what they need, and we structure the learning around that. It’s fundamental to our mandate.

You are based in Washington, DC, the seat of a government that is, at least federally, not committed to climate action, energy efficiency and renewables. What do you tell the nations you work with about the missing leadership at home?

No matter who we are speaking with, we have to make sure that our message is being heard and absorbed. The way you message, and what you say, your narrative, and the people to whom you choose to deliver the message is very important. People may seem to be at opposite positions, very far apart, but in the end they aspire to meet similar objectives. Nobody disputes the idea that more jobs are a good thing. Nobody disputes that industry-driving climate action is good. Nobody disputed the health benefits of clean energy—a lot of cities are facing serious air pollution problems. Nobody disputes that climate variability is there. We have to find ways of bringing people into the conversation.

This is a special year for the CIF in that it marks a decade since the fund was first established. What are you doing to recapitalize?

Our anniversary this year gives us an opportunity to really demonstrate the value we’ve added. When you work at the scale that we do, it can take years before you start to see impacts and results; now we have this really large portfolio of more than 300 projects in developing countries. We are gathering all this evidence and will be able to demonstrate the value and the importance of flexible toolkits and mechanisms. Watch this space.

Some say climate action needs less talk and, as the name implies, more action. But since our founding ten years ago, action is all we’ve ever done. Now is finally the time to start talking about the gains we’ve made and the progress still to come.

There will be representatives from more than 55 nations on hand at GLOBE Forum 2018. What is the one thing you would like them to remember, to keep in mind, about the Climate Investment Funds?

CIF began life at the height of the global financial crisis in 2008, when public funding was in some ways scarcer than it is today. Key to our success then, as now, was conveying the message that climate action is not only a worthy investment, but also a crisis that threatens nearly every aspect of our lives. It pollutes the air we breathe, fuels the natural disasters that destroy lives and livelihoods, hastens the spread of disease, and disrupts ecosystems as well as natural resources. Think of water scarcity. The sooner we think of climate change as an all-encompassing challenge – and one that jeopardizes our way of life – the sooner, I hope, we will marshal the necessary resources to address it.

CIF is just one part of the solution. This is a responsibility we all share, whether you’re an elected official, an activist, or an everyday consumer. Because we all have a stake in a climate-smarter future.

Image: Morrocco’s Concentrated Solar Power Plant Noor-Ouarzazate, www.climateinvestmentfunds.org

GLOBE Capital returns to Toronto on February 27-28, 2019.

Join leaders in finance, infrastructure and cleantech to discuss how to capitalize on opportunities in the clean economy.

Learn more